Tuesday, October 31, 2006

Lure of Flying South for the Winter

So the kids are launched, your job is winding down, and the Canadian dollar's looking strong. Why not fly south for a well-deserved break each winter?

Many retirees have already made the move, with some half-million Canadians perched across a half-dozen southern U.S. states from now until next April.

But there are lots of calculations and considerations involved in seeing if the snowbird lifestyle is right for you and determining the best way to go about it, say financial planners, legal experts and snowbirds themselves.

"It pays to do a lot of homework," says Jim Grieves, 68, a retired sales and marketing executive in Tottenham, Ont. After the last of their four children left home six years ago, Mr. Grieves and his wife Jean, 68, decided after doing the numbers to head for the Sarasota area in Florida for six months each year. "You don't want to come across any surprises," he says.

It pays to be prudent, says Ron Harvey, a certified financial planner in Ottawa who at 54 is himself a recent empty nester considering such issues. He has a number of clients who, crossing the double threshold of newly becoming empty nesters while at the same time retiring, are considering major expenditures and life changes, from taking expensive foreign trips to becoming snowbirds. He cautions them to pause and enumerate all of the costs and other issues involved in such moves and how these might affect their overall life plans and budgets.

"People start looking for the great big instant reward, but this is just the beginning of the next stage of your life, and you have to think about how things fit into your goals and dreams," says Mr. Harvey, adding that people should especially consult with a financial planner in such cases. "Don't get caught up in the emotional excitement as opposed to the economic reality of what you can afford."

One of the biggest issues for older Canadians moving to the United States for a period each year is the cost of medical insurance and making sure it's going to kick in when provincial health care plans don't.

"You've got to make sure you're covered for what's wrong with you and what could be wrong with you," says Gerry Brissenden, 75, who lives near Orillia, Ont., and is president of the Canadian Snowbird Association. The group represents some 70,000 members who spend up to six months a year living outside the country.

Mr. Brissenden and his wife Joan, 75, a retired executive secretary, became snowbirds 13 years ago as their four boys moved out of the house. At that time they paid about $300 each for medical insurance; today they pay $1,500 each, which covers everything from regular medical appointments to emergency care while away.

Mr. Brissenden recommends that people look not just at the lowest-cost insurance option but consider which policy works best for them, and especially fill out applications honestly in terms of pre-existing health issues, from stress to medical conditions. He says that medical insurance should work so that you never pay a hospital or doctor directly but send any bills to the insurance company to recoup the money from your provincial system and pay the balance. Some company pension plans provide medical insurance that may have to be topped up for long out-of-country stays.

Getting money to the United States is another major issue. The Snowbird Association offers a currency exchange program that allows members (and non-members, for a small fee) to have money transferred between their accounts at Canadian and U.S. banks at good rates. Using credit cards or withdrawing cash from bank machines in the U.S. is an option, but exchange rates can be punitive.

Terry Ritchie is a certified financial planner at Transitional Financial Advisors Inc., a company based in Calgary and Arizona that assists Canadians and Americans with cross-border issues. He recommends that snowbirds hold U.S. investments that pay for their time in the south rather than speculating about what the Canadian dollar might do.

"When you're in the U.S., you should use U.S. dollars to support your U.S. lifestyle, and in Canada spend your Canadian dollars," Mr. Ritchie explains.

When it comes to U.S. immigration and tax rules, timing is everything, he adds. Under immigration law, Canadians can spend up to six months in the States, but tax laws calculate your stay over a three-year period and state that anyone who spends more than four months a year in the country is "substantially present" there and subject to tax on their worldwide income.

Snowbirds can file a simple Closer Connection Exemption Statement that relieves them from this as long as they don't have U.S. employment income or operate a business there. Those who do earn money in the United States (from the sale or rental of U.S. property, for example) have to file a U.S. tax return reporting that income.

Mr. Ritchie says snowbirds should also make sure that legal documents such as wills, powers of attorney and health directives such as living wills apply in the jurisdictions where they are wintering, or have new ones drafted there.

Where to settle in your new snowbirding life is another issue. Mr. Harvey suggests that clients go south for short periods to try out different places rather than - or at least before - settling on one in particular, especially if they are buying.

The Grieves had a feeling they would eventually live part-time in Florida because they honeymooned there in 1958, and checked out different areas each time they visited over the years. In 1999, they bought a "manufactured home" in a senior's community that offered optional social activities and was home to a fair number of other Canadian snowbirds.

Other issues to consider when it comes to location, Mr. Grieves says, include proximity to airports, hospitals, beaches and amenities for people who visit, such as grandchildren.

Empty nesters usually have the advantage of being able to downsize their Canadian home to help pay for a home in the States, but "it can become costly to keep two places going," Mr. Brissenden says.

Issues associated with your Canadian property include carrying costs as well as maintaining a minimum level of heat and ensuring someone trustworthy keeps an eye on your place through the winter. Other practicalities include redirecting mail, at a cost of about $100 for six months, and paying Canadian bills, which can be done by automatic debit or telephone. The Brissendens have bills forwarded down south and pay them on-line.

In the south, homeowner insurance can be a major cost, especially in Florida. Some insurers are not handling new policies at all, forcing people to opt for much more costly insurance offered by the state.

In terms of the cost of everyday items in the United States, prices are still significant, even with the higher Canadian dollar. Mr. Grieves notes that gas, liquor and other luxuries remain the only things that are cheaper south of the border.

Thinking of migrating?

One of the main questions snowbirds have to consider is, is it better to rent or to own? Lawrence Barker of the Canadian Snowbird Association offers a few tips to consider:

Check out the taxes: Property taxes can be higher for temporary residents in some states.

Get legal advice: Always use a lawyer when buying or selling property.

Rent before you own: See if the area and lifestyle suit you before making the investment.

Know the operating costs: Make sure your budgeting includes all the costs of running two homes, including condominium or common fees and insurance coverage.

Renting out can be tricky: Renting your seasonal property can help defray costs but it may be subject to certain rules and you'll likely be required to take out additional home insurance.

Research the area: Communities and boards of trade issue information on costs, demographics, climate and other local factors to consider.

Many retirees have already made the move, with some half-million Canadians perched across a half-dozen southern U.S. states from now until next April.

But there are lots of calculations and considerations involved in seeing if the snowbird lifestyle is right for you and determining the best way to go about it, say financial planners, legal experts and snowbirds themselves.

"It pays to do a lot of homework," says Jim Grieves, 68, a retired sales and marketing executive in Tottenham, Ont. After the last of their four children left home six years ago, Mr. Grieves and his wife Jean, 68, decided after doing the numbers to head for the Sarasota area in Florida for six months each year. "You don't want to come across any surprises," he says.

It pays to be prudent, says Ron Harvey, a certified financial planner in Ottawa who at 54 is himself a recent empty nester considering such issues. He has a number of clients who, crossing the double threshold of newly becoming empty nesters while at the same time retiring, are considering major expenditures and life changes, from taking expensive foreign trips to becoming snowbirds. He cautions them to pause and enumerate all of the costs and other issues involved in such moves and how these might affect their overall life plans and budgets.

"People start looking for the great big instant reward, but this is just the beginning of the next stage of your life, and you have to think about how things fit into your goals and dreams," says Mr. Harvey, adding that people should especially consult with a financial planner in such cases. "Don't get caught up in the emotional excitement as opposed to the economic reality of what you can afford."

One of the biggest issues for older Canadians moving to the United States for a period each year is the cost of medical insurance and making sure it's going to kick in when provincial health care plans don't.

"You've got to make sure you're covered for what's wrong with you and what could be wrong with you," says Gerry Brissenden, 75, who lives near Orillia, Ont., and is president of the Canadian Snowbird Association. The group represents some 70,000 members who spend up to six months a year living outside the country.

Mr. Brissenden and his wife Joan, 75, a retired executive secretary, became snowbirds 13 years ago as their four boys moved out of the house. At that time they paid about $300 each for medical insurance; today they pay $1,500 each, which covers everything from regular medical appointments to emergency care while away.

Mr. Brissenden recommends that people look not just at the lowest-cost insurance option but consider which policy works best for them, and especially fill out applications honestly in terms of pre-existing health issues, from stress to medical conditions. He says that medical insurance should work so that you never pay a hospital or doctor directly but send any bills to the insurance company to recoup the money from your provincial system and pay the balance. Some company pension plans provide medical insurance that may have to be topped up for long out-of-country stays.

Getting money to the United States is another major issue. The Snowbird Association offers a currency exchange program that allows members (and non-members, for a small fee) to have money transferred between their accounts at Canadian and U.S. banks at good rates. Using credit cards or withdrawing cash from bank machines in the U.S. is an option, but exchange rates can be punitive.

Terry Ritchie is a certified financial planner at Transitional Financial Advisors Inc., a company based in Calgary and Arizona that assists Canadians and Americans with cross-border issues. He recommends that snowbirds hold U.S. investments that pay for their time in the south rather than speculating about what the Canadian dollar might do.

"When you're in the U.S., you should use U.S. dollars to support your U.S. lifestyle, and in Canada spend your Canadian dollars," Mr. Ritchie explains.

When it comes to U.S. immigration and tax rules, timing is everything, he adds. Under immigration law, Canadians can spend up to six months in the States, but tax laws calculate your stay over a three-year period and state that anyone who spends more than four months a year in the country is "substantially present" there and subject to tax on their worldwide income.

Snowbirds can file a simple Closer Connection Exemption Statement that relieves them from this as long as they don't have U.S. employment income or operate a business there. Those who do earn money in the United States (from the sale or rental of U.S. property, for example) have to file a U.S. tax return reporting that income.

Mr. Ritchie says snowbirds should also make sure that legal documents such as wills, powers of attorney and health directives such as living wills apply in the jurisdictions where they are wintering, or have new ones drafted there.

Where to settle in your new snowbirding life is another issue. Mr. Harvey suggests that clients go south for short periods to try out different places rather than - or at least before - settling on one in particular, especially if they are buying.

The Grieves had a feeling they would eventually live part-time in Florida because they honeymooned there in 1958, and checked out different areas each time they visited over the years. In 1999, they bought a "manufactured home" in a senior's community that offered optional social activities and was home to a fair number of other Canadian snowbirds.

Other issues to consider when it comes to location, Mr. Grieves says, include proximity to airports, hospitals, beaches and amenities for people who visit, such as grandchildren.

Empty nesters usually have the advantage of being able to downsize their Canadian home to help pay for a home in the States, but "it can become costly to keep two places going," Mr. Brissenden says.

Issues associated with your Canadian property include carrying costs as well as maintaining a minimum level of heat and ensuring someone trustworthy keeps an eye on your place through the winter. Other practicalities include redirecting mail, at a cost of about $100 for six months, and paying Canadian bills, which can be done by automatic debit or telephone. The Brissendens have bills forwarded down south and pay them on-line.

In the south, homeowner insurance can be a major cost, especially in Florida. Some insurers are not handling new policies at all, forcing people to opt for much more costly insurance offered by the state.

In terms of the cost of everyday items in the United States, prices are still significant, even with the higher Canadian dollar. Mr. Grieves notes that gas, liquor and other luxuries remain the only things that are cheaper south of the border.

Thinking of migrating?

One of the main questions snowbirds have to consider is, is it better to rent or to own? Lawrence Barker of the Canadian Snowbird Association offers a few tips to consider:

Check out the taxes: Property taxes can be higher for temporary residents in some states.

Get legal advice: Always use a lawyer when buying or selling property.

Rent before you own: See if the area and lifestyle suit you before making the investment.

Know the operating costs: Make sure your budgeting includes all the costs of running two homes, including condominium or common fees and insurance coverage.

Renting out can be tricky: Renting your seasonal property can help defray costs but it may be subject to certain rules and you'll likely be required to take out additional home insurance.

Research the area: Communities and boards of trade issue information on costs, demographics, climate and other local factors to consider.

Canadian Government Needs 89,000 New IT Workers

The Canadian Government will need to replace more than 7,000 information technology (IT) professionals in the next 3(three) years.

So, over the next 3-5 years, 89000 more homes will be required just to meet the immediate need in Ottawa.

The federal public service will find itself in an IT crunch unless declining computer studies programs produce more graduates.

Canadian governments, banks, insurance companies and technology companies will likely need to fill a staggering 89,000 technology positions in the next 3 to 5 years.

A number of factors are working against the Canadian labour market, such as a rapidly aging workforce, including those in charge of technology groups in the public service and migration of qualified workers to the U.S.

All across the country, governments and private industry have done a poor job driving home the point that the country faces a shortage of computer studies graduates.

Since much of the entry level work done in the tech sector is being outsourced to cheaper labour markets like India, the entry level technology positions available for Canadian graduates will require more sophisticated training.

Halloween House

Halloween has always been one of our favorite holidays!

How about you?

Watch out for the ghosts!

Tricks and Treats!

Want to have a Haughted House?

- First, you have to set the mood.Have some Halloween music playing in the background, & turn the lights down a little, not too much though,you do not want someone to trip! Or,you can use a black, or green light bulb, we got ours at Wal-Mart.

- Second,you have to decorate it! Start by putting up some cobwebs. We use quilt batting or fiberfill that we stretch out to look like cobwebs or you can buy them in a store,which ever you would like!

- We also put up orange & black crape paper, & balloons.

- You can make your own invitations using construction paper & color crayons, markers & stickers. Make sure to put the time on them!

- We like to have a part of the Haughted House be a guessing area. We take a cardboard box, cut out a hole big enough for hands to go through, then decorate it, & put it on it's side. We put a lot of these on a long table, then put different things in the boxes for the guest's to feel. We make them seem like scary things. Here are some ideas: For teeth, we use Indian corn kernels or unpopped popcorn. For fingers, use cut-up hotdogs.If it is not too scary, use cold, cooked spaghetti for brains.For eyes,use grapes.

- Use whatever else you can think of ! Have the guests move down the table feeling one thing at a time. Have fun with it!

- Have fun with your Haughted House! We serve treats & punch,play Halloween games, & make Halloween crafts

Change Your Clock – Change Your Batteries!

The Ottawa Housing Market Blog would like to remind you to replace smoke alarm batteries when setting your clocks back one hour on Sunday, October 29, 2006.

The Ottawa Housing Market Blog would like to remind you to replace smoke alarm batteries when setting your clocks back one hour on Sunday, October 29, 2006.Working smoke alarms provide early smoke detection, and can save your life and that of a loved one. Statistics show that fewer deaths or serious injuries occur in households where smoke alarms are installed and maintained.

As of March 1, 2006, an amendment in the Ontario Fire Code requires you to have a working smoke alarm outside every sleeping area and on every level of your home.

The best way to be safe is to be prepared before a fire strikes.

Monday, October 30, 2006

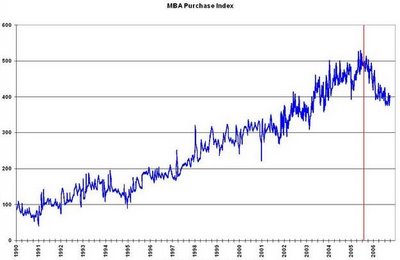

U.S. Housing Bubble has Finally Burst

After the longest and most gravity-defying run-up in US house prices in history, the bubble has finally burst.

After the longest and most gravity-defying run-up in US house prices in history, the bubble has finally burst.In the three months to September 2006 residential investment declined at an annual rate of 17 %, a weighty blow to overall output.

House prices have fallen across the U.S. in the past 6 months. We may even experience the first calendar-year decline in the median national house price since accurate records began half a century ago. Since it was housing that was propping up the economy for the past five years, it is said, the outlook is bleak.

The problem in the story is this. Construction and housing-related economic activity were supposed to be only one, relatively small, part of the effect of the deflation of the housing bubble on demand. The much bigger drag on growth was expected to come not from the direct effect of a reduction in activity by builders but in a reduction in the estimated housing wealth of tens of millions of Americans. The decline in prices was supposed to chill consumers, who would rush to redress their balance sheets by increasing savings and reducing consumption.

The pessimists argue that the worst is yet to come, that the housing market will continue to weaken and, after a suitable time lag, the consumption effect will be deep and powerful. But the direction of house prices, and their effect on consumption, is highly uncertain.

While other markets certainly tend to overshoot when they correct, housing is different. As prices fall, householders simply opt not to sell and stay longer where they were, keeping prices sticky. And though the recent residential slump is far from over, the latest data on such indicators as mortgage applications suggest at least that the pace of decline is slowing sharply.

In any case, what the consumer has lost from the fall in the price of his house, he has probably gained from a fortunate confluence of economic events (oil or stocks).

How Bad the Housing Market Will Get

For homeowners who aren't planning to sell, the market likely looks just fine.

If people are planning to stay in their home for more than the next 12 to 18 months, I don't think they're feeling the nervousness.

It's always the people who are facing the issue to sell. They're moving, they may have some other changes in their life, divorce. Those things cause more anxiety around home values.

Many homeowners are likely still enjoying recent gains. Even with a dip in market values, they're probably still finding positive equity gains over the last few years. From that standpoint, it's still a very positive feeling.

What we've always noticed is it takes consumers a while to perhaps understand what's really going on in the market.

By the time some consumers see the housing market in a negative light, it may be time to change their minds again, that the housing market will only see a slight dip.

The economy is not very strong, but if it continues with some positive growth and if interest rates stay stable over the next year or so, we will see the housing market towards the end of 2007 start appreciating again. Not very much, but it could start appreciating again. The danger is in this next 12-month period. There are a lot of what-ifs: What will happen with inflation, in the job market.

If people are planning to stay in their home for more than the next 12 to 18 months, I don't think they're feeling the nervousness.

It's always the people who are facing the issue to sell. They're moving, they may have some other changes in their life, divorce. Those things cause more anxiety around home values.

Many homeowners are likely still enjoying recent gains. Even with a dip in market values, they're probably still finding positive equity gains over the last few years. From that standpoint, it's still a very positive feeling.

What we've always noticed is it takes consumers a while to perhaps understand what's really going on in the market.

By the time some consumers see the housing market in a negative light, it may be time to change their minds again, that the housing market will only see a slight dip.

The economy is not very strong, but if it continues with some positive growth and if interest rates stay stable over the next year or so, we will see the housing market towards the end of 2007 start appreciating again. Not very much, but it could start appreciating again. The danger is in this next 12-month period. There are a lot of what-ifs: What will happen with inflation, in the job market.

Sunday, October 29, 2006

Enmity between Bank of Canada and CMHC

There have been rocky relations between the Bank of Canada (BoC), and the embattled Canada Mortgage and Housing Corp (CMHC).

There have been rocky relations between the Bank of Canada (BoC), and the embattled Canada Mortgage and Housing Corp (CMHC).The president and CEO of the CMHC uses unusually strong language to criticize new lending policies announced by the federal corporation over the summer 2006:

I read with interest and dismay your press release of June 28 which indicated that CMHC would offer mortgage insurance for interest-only loans and for amortizations of up to 35 years.

Particularly disturbing to me is the rationale you gave that 'these innovative solutions will allow more Canadians to buy homes and to do so sooner'.

We were reassured by the fact that CMHC's interest-only mortgage product includes no change in mortgage qualification criteria and as such would not be of significant concern to the bank

The CMHC's actions are likely to drive up house prices and make homes less affordable, not more.

By stoking inflation with proposed new policies, the CMHC is undermining the work of the BoC with "very unhelpful" actions.

The letter then upbraided the agency for blindsiding key government institutions.

Saturday, October 28, 2006

Housing Prices Plunge in the United States

The price of new homes in the U.S. took its biggest plunge last month since 1970, underscoring for Americans the cascading effect of the country's housing slump.

Faced with a growing glut of unsold homes, U.S. builders are resorting to unusually deep discounts that some analysts fear could turn off potential home buyers, feeding an even steeper downward price spiral.

Falling prices deter buyers. When the new home market goes south, the early buyers can get hurt. That's because buyers may be reluctant to lock in at today's prices if they believe homes will be significantly cheaper in a month or two.

The median price of new homes fell at an annual rate of 9.7 % to $217,000 in September. It was the fourth-largest decline on record since 1970.

At the same time, the volume of sales rose 5.3 % to 1.07 million. The increase follows large downward revisions in the previous two months.

There is also a lag effect of falling prices because most people aren't selling homes in any given month. It may take a while for Americans to realize their homes aren't worth as much as they assumed, and in some cases, as much as they paid for them.

Falling prices aren't confined to the new-home market, which accounts for about 15 % of home sales in the United States. The bulk of transactions involve existing homes, where prices are also falling.

The median price of existing homes fell at an annual rate of 1.8 % last month, and is down 2.2 % from the previous year.

The pressure on the housing market won't end any time soon.

Both new and existing single-family home prices are deflating, which will make households feel poorer.

Economists cautioned, however, that the new-homes sales report is notoriously volatile because builders have greater control over selling prices than individual sellers. Nor do the figures account for the size or quality of homes sold.

There is also evidence that builders have resorted to selling smaller and less opulent homes to attract buyers who have been shut out of the housing boom in many parts of the country.

Monthly mortgage payments have been inching up steadily and now account for nearly 25 % of homeowners' income, up from 19 % in 2003. In California, the ratio is 36.6 %, well above the 30 % threshold of what experts deem affordable.

The uncertainty in the housing market has also spilled over into the rental market, where many would-be home buyers are opting to rent, hoping that prices will fall in the months ahead.

And that is inflating rents and pushing down the vacancy rate. In the quarter ended Sept. 30, the average advertised rent reached $978, up 3.9 per cent from the year-ago period.

Good News for Buyers is Sellers' Woe

Since 2005, demand for housing in many areas of the country has slowed.

And in the last few months, even markets that had withstood the slowdown, have also begun to mirror that trend.

With the slackening demand, home sale prices also sagged.

This is definitely more of a buyers market right now. But a lot of this has been anticipated for some time now.

I'd definitely say we have a correction or an adjustment going on. But this is not a bust or a tanking, by any stretch.

The market climate is not as hospitable to sellers as it was as recently as last year, as the market is replete with "inventory," or unsold houses.

But while not ideal for sellers, the market is strong for buyers.

In general, the Ottawa market is not bad at all. The local market demand figures are deceptive.

We're seeing a lot of inflated figures right now, because these spec homes are just sitting there.

The builders overestimated the demand for housing in the Ottawa area.

They think it's going to be just like the suburbs. Just build it, and people buy it.

But we're not at that point yet.

However, despite the slowdown, observers, the housing market, both locally and statewide, will soon pick up again, trending upward by early 2007.

And in the last few months, even markets that had withstood the slowdown, have also begun to mirror that trend.

With the slackening demand, home sale prices also sagged.

This is definitely more of a buyers market right now. But a lot of this has been anticipated for some time now.

I'd definitely say we have a correction or an adjustment going on. But this is not a bust or a tanking, by any stretch.

The market climate is not as hospitable to sellers as it was as recently as last year, as the market is replete with "inventory," or unsold houses.

But while not ideal for sellers, the market is strong for buyers.

In general, the Ottawa market is not bad at all. The local market demand figures are deceptive.

We're seeing a lot of inflated figures right now, because these spec homes are just sitting there.

The builders overestimated the demand for housing in the Ottawa area.

They think it's going to be just like the suburbs. Just build it, and people buy it.

But we're not at that point yet.

However, despite the slowdown, observers, the housing market, both locally and statewide, will soon pick up again, trending upward by early 2007.

Friday, October 27, 2006

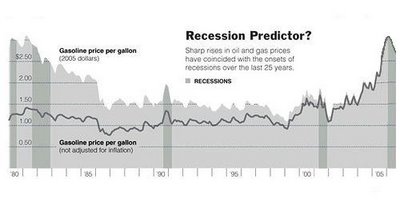

Recession

A significant decline in activity spread across the economy, lasting longer than a few months. It is visible in industrial production, employment, real income, and wholesale-retail trade. The technical indicator of a recession is two consecutive quarters of negative economic growth as measured by a country's GDP.

Recession is a normal (albeit unpleasant) part of the business cycle. A recession generally lasts from six to eighteen months.

Interest rates usually fall in recessionary times to stimulate the economy by offering cheap rates at which to borrow money.

After nearly a year of falling commodity prices, rising unemployment, increasing personal and corporate bankruptcies, falling stock prices, and declining public confidence, the National Bureau of Economic Research made it official and on November 26, 2001, declared a recession. The announcement wasn't a surprise to hundreds of thousands of people who had lost their jobs and an even greater number of investors who had experienced substantial losses in the stock market. The bureau's Business Cycle Dating Committee of six academic economists determined the recession commenced in March 2001, when economic activity stopped growing. Although many economists use declines in gross domestic product to define a recession, the NBER Dating Committee examined employment, industrial production, manufacturing and trade sales, and personal income. The country's last previous recession lasted eight months and ended in March 1991. The subsequent ten-year period of uninterrupted growth between March 1991 and March 2001 was the longest in America's history.

Slumping Ottawa Housing Market

The slumping housing market figured prominently in the economy‘s dramatic loss of momentum. Investment in homebuilding was cut by the biggest amount since early 1991.

The housing bubble burst and that really knocked down growth.

Everybody expected this. You have a combination of rising energy prices and also rising interest rates, and now you‘ve seen a reverse on both.

Economists took heart that consumers and businesses — outside of the residential sector_ spent solidly — which helped to cushion some of the fallout from the housing slump.

Spending on home building dropped at a rate of 17.4 % in the third quarter. That was the biggest drop since the first quarter of 1991 when such spending was sliced at a 21.7 % pace.

Weak inventory building by businesses also played roles in weighing down economic activity in the 3rd quarter 2006.

Even with the feeble third-quarter showing, analysts didn‘t believe the economy was in danger of sliding into recession.

The housing bubble burst and that really knocked down growth.

Everybody expected this. You have a combination of rising energy prices and also rising interest rates, and now you‘ve seen a reverse on both.

Economists took heart that consumers and businesses — outside of the residential sector_ spent solidly — which helped to cushion some of the fallout from the housing slump.

Spending on home building dropped at a rate of 17.4 % in the third quarter. That was the biggest drop since the first quarter of 1991 when such spending was sliced at a 21.7 % pace.

Weak inventory building by businesses also played roles in weighing down economic activity in the 3rd quarter 2006.

Even with the feeble third-quarter showing, analysts didn‘t believe the economy was in danger of sliding into recession.

U.S. is Sliding Into Recession

The growth of U.S. Gross Domestic Product slowed to 1.6 % for the 3rd quarter of 2006, its smallest advance in more than 3 years. Economists had been expecting growth of 2.1 %. The slow down in the housing market is the primary factor effecting U.S. economic growth. Sales of existing homes had increased in September 2006, however the prices paid for these homes was down dramatically. Overall for the quarter spending on new housing is down by 17.4 $. With inflation an ever-present concern for the U.S. this latest slowdown may be signaling that the country is sliding into recession.

Thursday, October 26, 2006

Apartment Rents and Demand are Soaring in Ottawa

Apartment rents and demand are soaring as the economy produces good jobs and people who might have bought homes a year ago settle for apartments while they wait for housing prices to tumble.

In the quarter ended Sept. 30, the average advertised rent reached $978, up 3.9 % over the year-ago period.

The market is strong enough that landlords are able to reduce the concessions that they‘re offering to new tenants. Even more important, vacancies continue to fall.

The surging demand has also benefited owners and operators of large apartment complexes. Its revenue rose 6.6 % in the quarter ended June 30, compared to the same period last year.

Competition for units has grown along with the rent.

Slowing Housing Market is Forcing Agents to Embrace Unusual Sales Tactics

The slowing housing market is forcing some real estate agents and builders to embrace unusual sales tactics.

The slowing housing market is forcing some real estate agents and builders to embrace unusual sales tactics.That means paying a neighbor kid $50 to stand along a street in a bear costume and direct traffic to one of real estate listings.

Did that get attention? Yes it did. Did it bring a buyer? No.

Home builders are among those most affected. In September, builders posted one of their worst months in a decade. Last month, the number of planned units to be built in the city area was down 48 %, and total permit activity was down 23 % from January through September.

Wednesday, October 25, 2006

Median Home Sales Price Dropped

Sales of existing homes fell for a 6th straight month in September and the median sales price dropped by a record amount, in further evidence of a sharp slowdown in the once-booming housing market,

The median price of a single-family home fell to $219,800 last month, a drop of 2.5 % from the price in September 2005. That was the biggest year-over-year price decline in records going back nearly four decades. Home prices had also fallen in August and it marked the first back-to-back declines in 16 years.

Housing, which had set sales records for both new and existing homes for 5 consecutive years, has been rapidly cooling this year, but economists with the Realtors suggested that the decline could be hitting bottom.

Other economists suggested the weakness in housing could last for a number of more months and perhaps as long as another year because of a huge backlog of unsold homes.

Existing home sales will fall by 9 % this year and will drop by an even bigger 14 % in 2007.

The inventory of unsold homes, after climbing to all-time highs, fell for a second straight month, decreasing 2.4 %, to 3.75 million unsold homes at the end of September, which represents a 7.3 months supply at the September sales pace.

The median price of a single-family home fell to $219,800 last month, a drop of 2.5 % from the price in September 2005. That was the biggest year-over-year price decline in records going back nearly four decades. Home prices had also fallen in August and it marked the first back-to-back declines in 16 years.

Housing, which had set sales records for both new and existing homes for 5 consecutive years, has been rapidly cooling this year, but economists with the Realtors suggested that the decline could be hitting bottom.

Other economists suggested the weakness in housing could last for a number of more months and perhaps as long as another year because of a huge backlog of unsold homes.

Existing home sales will fall by 9 % this year and will drop by an even bigger 14 % in 2007.

The inventory of unsold homes, after climbing to all-time highs, fell for a second straight month, decreasing 2.4 %, to 3.75 million unsold homes at the end of September, which represents a 7.3 months supply at the September sales pace.

Tuesday, October 24, 2006

Ottawa Big Homes Having Trouble Selling

Sales of higher-priced homes appear to be slowing.

What we're hearing anecdotally and by pulling stats is that homes priced above $300,000 are taking longer to sell.

Buyers are showing greater interest in mid-priced condominiums.

We're getting a lot of people that don't want big houses, big lots or big maintenance.

Nationwide, home sales appeared to be bottoming out, with lower home prices attracting buyers in many areas of the country.

Ottawa Plans for 100 New Soccer Fields

Ottawa announced plans yesterday to construct 100 new soccer fields over the next four years as a legacy project of the FIFA Under-20 World Cup.

FIFA declared Ottawa an official FIFA city.

Ottawa is one of six Canadian communities that will host the U-20 World Cup next June and July.

Soccer is the fastest growing sport in Ottawa. We have more people playing soccer now than hockey, and we have tremendous demand from all the people playing soccer.

The city already had plans to construct 40 new soccer fields by 2010, and that provincial funding could be available to help swell the total to 100.

Sunday, October 22, 2006

Canadians' Personal Debt at Historic Level. No Savings?

Ever wondered how some of your neighbours afford their nice big house, that Lexus or BMW SUV sitting in their driveway, the yearly holidays to exotic destinations? You are not imagining things: These days, you don't need the right income to live the middle-class lifestyle. You just need credit, and there is plenty of it to go around.

It has never been easier to give the appearance of greater wealth. Families are borrowing off home equity, using multiple credit cards, taking on bigger mortgages and using a proliferation of short-term loan services.

Canadians are borrowing themselves into debt to live in the right neighbourhoods and send their children to the best schools.

It is the "credit generation." Not only are people borrowing more, the savings rate in Canada is next to zero and hasn't been this low in close to 80 years.

Household debt rising twice as fast as disposable income over the past 15 years. Canadians were 7% more indebted than they were the previous year, and 20% more than they were at the beginning of the decade. The trend is continuing.

The appetite for more and more credit is being fed by a growing network of services catering to people who want to live a notch above what their income allows. Consumers can drive luxury cars without buying them, there has been an explosion of payday loan shops, there are furniture loans that put off payments for months. Even private schools, once the domain of the rich, are more affordable because of various financial aid programs such as monthly tuition payment plans, deferred-payment plans, scholarship or partial subsidy programs offered by an array of outside groups. Then there are banks, which are increasingly in competition to lend money.

All of this has been aided by low interest rates, which make borrowing cheap. The housing boom has also made some people feel richer and led them deeper into debt. Some have traded up to bigger houses, but others are borrowing more based on the increased value of their home. On paper, they may have made, say $20,000, as the value of their home went up, so they go to the bank and borrow off that equity. They also gain more confidence about their financial picture and aspire to live better.

People are also not putting money away as they should. Canadians aged 55 and older are the only group of what he calls active savers. Younger consumers are passive savers and will, for example, count money they've made on paper in the housing market as their savings.

It has never been easier to give the appearance of greater wealth. Families are borrowing off home equity, using multiple credit cards, taking on bigger mortgages and using a proliferation of short-term loan services.

Canadians are borrowing themselves into debt to live in the right neighbourhoods and send their children to the best schools.

It is the "credit generation." Not only are people borrowing more, the savings rate in Canada is next to zero and hasn't been this low in close to 80 years.

Household debt rising twice as fast as disposable income over the past 15 years. Canadians were 7% more indebted than they were the previous year, and 20% more than they were at the beginning of the decade. The trend is continuing.

The appetite for more and more credit is being fed by a growing network of services catering to people who want to live a notch above what their income allows. Consumers can drive luxury cars without buying them, there has been an explosion of payday loan shops, there are furniture loans that put off payments for months. Even private schools, once the domain of the rich, are more affordable because of various financial aid programs such as monthly tuition payment plans, deferred-payment plans, scholarship or partial subsidy programs offered by an array of outside groups. Then there are banks, which are increasingly in competition to lend money.

All of this has been aided by low interest rates, which make borrowing cheap. The housing boom has also made some people feel richer and led them deeper into debt. Some have traded up to bigger houses, but others are borrowing more based on the increased value of their home. On paper, they may have made, say $20,000, as the value of their home went up, so they go to the bank and borrow off that equity. They also gain more confidence about their financial picture and aspire to live better.

People are also not putting money away as they should. Canadians aged 55 and older are the only group of what he calls active savers. Younger consumers are passive savers and will, for example, count money they've made on paper in the housing market as their savings.

Saturday, October 21, 2006

U.S. Finds Cooling in Housing Market

The U.S. economy continued to grow in the early fall despite a "widespread cooling" in the once-hot housing market.

The U.S. economy continued to grow in the early fall despite a "widespread cooling" in the once-hot housing market.However, there was a distinct slowdown in housing with the majority of the U.S. regions reporting lower asking prices for homes, a softening in sales and rising inventories of unsold homes.

The latest snapshot of the economy, based on reports from the Fed‘s regional banks, will be used when central bankers next meet on Oct. 24-25 to consider what to do with interest rates.

Minutes released on Wednesday of the Fed‘s deliberations in September found that Fed officials remained concerned about inflation. Those worries were seen as a signal that the Fed will not soon start cutting interest rates, something that financial markets had grown hopeful might occur given the spreading economic slowdown.

More Homeowners Going Into Default

The number of Californians who are significantly behind on their mortgage payments and at risk of losing their homes to foreclosure more than doubled in the three months ended Sept. 30, providing the latest evidence of trouble in the housing market, figures released Wednesday show.

Analogy of Housing to Donuts

It is like the room of 1,000 Tim Hortons donuts. Even if they are warm donuts from Tim Hortons, how many can you eat? Three? Maybe four? And even if you come back the next day, and the donuts are now half price, how many can you eat? Same thing with housing. We only have so many people in the Canada. But builders built houses like donuts. They sold houses to non-users. They sold houses to the greedy masses that bought multiple houses to flip. Now we have the inventory, but there are not enough people to occupy these homes. Moreover, with interest rates rising and mortgages becoming tougher to obtain, we have less and less people that can buy these homes, even if they want to.

It is like the room of 1,000 Tim Hortons donuts. Even if they are warm donuts from Tim Hortons, how many can you eat? Three? Maybe four? And even if you come back the next day, and the donuts are now half price, how many can you eat? Same thing with housing. We only have so many people in the Canada. But builders built houses like donuts. They sold houses to non-users. They sold houses to the greedy masses that bought multiple houses to flip. Now we have the inventory, but there are not enough people to occupy these homes. Moreover, with interest rates rising and mortgages becoming tougher to obtain, we have less and less people that can buy these homes, even if they want to.

Mortgage Carrying Costs in Ottawa

Ottawa standard housing affordability index measures the proportion of median pre-tax household income required to service the cost of a mortgage, including principal and interest, property taxes and utilities; the modified index used here includes the cost of servicing a mortgage, but excludes property taxes and utilities due to data constraints in the smaller CMAs. This measure is based on a 25% downpayment and a 25-year mortgage loan at a five-year fixed rate and is estimated on a quarterly basis. The higher the index, the more difficult it is to afford a house.

Ottawa standard housing affordability index measures the proportion of median pre-tax household income required to service the cost of a mortgage, including principal and interest, property taxes and utilities; the modified index used here includes the cost of servicing a mortgage, but excludes property taxes and utilities due to data constraints in the smaller CMAs. This measure is based on a 25% downpayment and a 25-year mortgage loan at a five-year fixed rate and is estimated on a quarterly basis. The higher the index, the more difficult it is to afford a house.

Steady-As-She-Goes in Ottawa’s Housing Market

Although housing affordability deteriorated across the board in the second quarter, conditions continue to remain fairly stable with little by way of affordability changes in the past decade. House price gains in Ottawa have been relatively more modest than in other markets in the past few years and have slowed to the 0-5% yearly range in every key housing class. Furthermore, the market is well-balanced between buyers and sellers with a sales-to-listings ratio of 0.6. Income growth has helped to offset the impact of rising mortgage rates, utilities costs and house prices. Except in the standard two-storey segment, qualifying incomes sit comfortably below average household income.

Although housing affordability deteriorated across the board in the second quarter, conditions continue to remain fairly stable with little by way of affordability changes in the past decade. House price gains in Ottawa have been relatively more modest than in other markets in the past few years and have slowed to the 0-5% yearly range in every key housing class. Furthermore, the market is well-balanced between buyers and sellers with a sales-to-listings ratio of 0.6. Income growth has helped to offset the impact of rising mortgage rates, utilities costs and house prices. Except in the standard two-storey segment, qualifying incomes sit comfortably below average household income.

Friday, October 20, 2006

Investment Eggs: Houses or Bonds?

If you're house-rich but other-asset-poor tilt investments more toward bonds than you otherwise might.

Bonds will act as a bit of a hedge: If the economy slows down, taking down the value of your house even further, bond prices will rise. They'll also produce more consistent returns and income for your mortgage payments than stocks will.

Avoid long-term bond funds and stick with ones that focus on shorter maturities. They're actually paying higher rates these days, and they're less volatile.

Because of rising short-term interest rates favors money-market funds. Given the relatively pricey stock market and real estate markets, those investments look less attractive. People today should not think of money-market funds as temporary parking places. Now they can serve as real investments for your portfolio.

You can get more aggressive about hedging by investing in options. You can buy a "put" option for your area, which could make you money if home prices fall.

It's akin to homeowners insurance. To hedge effectively, you'll need to put up 4 % to 5 % of your home's value. And since the futures market is already expecting prices to drop by next fall, the put will pay off for you only if the declines are precipitous. Otherwise, you will lose what you spent on the option.

Bond top choices:

FPA New Income (FPNIX) and Harbor Bond (HABDX).

Bonds will act as a bit of a hedge: If the economy slows down, taking down the value of your house even further, bond prices will rise. They'll also produce more consistent returns and income for your mortgage payments than stocks will.

Avoid long-term bond funds and stick with ones that focus on shorter maturities. They're actually paying higher rates these days, and they're less volatile.

Because of rising short-term interest rates favors money-market funds. Given the relatively pricey stock market and real estate markets, those investments look less attractive. People today should not think of money-market funds as temporary parking places. Now they can serve as real investments for your portfolio.

You can get more aggressive about hedging by investing in options. You can buy a "put" option for your area, which could make you money if home prices fall.

It's akin to homeowners insurance. To hedge effectively, you'll need to put up 4 % to 5 % of your home's value. And since the futures market is already expecting prices to drop by next fall, the put will pay off for you only if the declines are precipitous. Otherwise, you will lose what you spent on the option.

Bond top choices:

FPA New Income (FPNIX) and Harbor Bond (HABDX).

Thursday, October 19, 2006

Housing Boom Boosting Consumer Credit

The sizzling Ottawa housing market in Canada is prompting many residents to take out lines of credit, prompting a potentially inflationary burst in consumer spending.

The sizzling Ottawa housing market in Canada is prompting many residents to take out lines of credit, prompting a potentially inflationary burst in consumer spending.Homeowners across the country are taking advantage of the increase in their home equity to borrow more.

Resale house prices have risen an average of 4.4 % a year in real terms since 2001; from January 2005 to mid-2006 the cumulative rate of increase has been 10.7 % and much faster in western Canada.

While many factors, such as income and population growth, have contributed to this faster growth in credit, the rapid rise in house prices has been a significant factor.

Despite this strong credit growth, the debt-service burden of households continues to be modest, since rates on mortgages and consumer loans remain historically low.

Never Hire a Contractor Who is Going Door to Door

Even if these contractors (roofer, driveway paver or chimney sweep) aren't scam artists, they may lack licensing and insurance. If a worker gets hurt on your property it could wind up costing a lot more than you bargained for.

Instead, get contractor recommendations from friends, neighbors or relatives. Check references and get documentation of insurance coverage.

And don't put more than 10 % down for the job. Mete out the payments gradually as work is done and withhold the final 25 % until you're satisfied with the completed project.

Instead, get contractor recommendations from friends, neighbors or relatives. Check references and get documentation of insurance coverage.

And don't put more than 10 % down for the job. Mete out the payments gradually as work is done and withhold the final 25 % until you're satisfied with the completed project.

Ottawa Housing Payments

Spend no more than 2.5 times your income on a home. For a down payment, it's best to come up with at least 20-25 %.

Many buyers in recent years have stretched the limits of affordability, and have bypassed the traditional 5 - 20 % down model. But make a smaller down payment, and most lenders will require you to have Private Mortgage Insurance (PMI), which adds a minimum 0.5 % of the loan amount to your mortgage payments, about $1,000 more a year on a $200,000 principal.

Your total housing payments should not exceed 28 % of your gross income. Total debt payments should come in under 36 %. These guidelines include payment on all loans, such as school and auto loans and credit card debt.

Also remember to take into account other home-related expenses to judge a house's affordability. Property and school taxes, home insurance and energy costs and requirements can vary considerably around the nation.

Try to estimate future maintenance costs and work them into your budget. Some homes, especially older ones, may require more regular upkeep than homes built with more modern materials. Roofs, siding and heating, cooling, plumbing, and electric services may have to be replaced within a few years of purchase.

Many buyers in recent years have stretched the limits of affordability, and have bypassed the traditional 5 - 20 % down model. But make a smaller down payment, and most lenders will require you to have Private Mortgage Insurance (PMI), which adds a minimum 0.5 % of the loan amount to your mortgage payments, about $1,000 more a year on a $200,000 principal.

Your total housing payments should not exceed 28 % of your gross income. Total debt payments should come in under 36 %. These guidelines include payment on all loans, such as school and auto loans and credit card debt.

Also remember to take into account other home-related expenses to judge a house's affordability. Property and school taxes, home insurance and energy costs and requirements can vary considerably around the nation.

Try to estimate future maintenance costs and work them into your budget. Some homes, especially older ones, may require more regular upkeep than homes built with more modern materials. Roofs, siding and heating, cooling, plumbing, and electric services may have to be replaced within a few years of purchase.

Will Refinancing Your Mortgage Save You Money?

There are transaction costs and fees involved in any refinancing that must be either paid out of pocket or added to the mortgage principal. Some of those costs can be considerable. Title insurance can easily run into four figures and broker fees can be expensive as well.

Like many things in life, timing is everything here. Is your job likely to relocate soon? Will you need a bigger house in the next couple of years? Unless you're planning to stay in the home for a while, the benefits of a lower monthly bill may not be worth the additional expenses that refinancing generates.

You need to find out how much refinancing costs. First, check to see if your present mortgage has any kind of prepayment penalty. Next, compare interest rates and loan types for at least three lending institutions. Find out what kinds of fees or closing costs are charged for a new mortgage. Fees for the appraisal, loan application, title search, title insurance, home inspection, and legal advice are common costs. Loan origination fees (also called points) are the largest closing cost you will pay. A point is usually one percent of the total loan. One point or one percent of a $90,000 loan would be $900.

Like many things in life, timing is everything here. Is your job likely to relocate soon? Will you need a bigger house in the next couple of years? Unless you're planning to stay in the home for a while, the benefits of a lower monthly bill may not be worth the additional expenses that refinancing generates.

You need to find out how much refinancing costs. First, check to see if your present mortgage has any kind of prepayment penalty. Next, compare interest rates and loan types for at least three lending institutions. Find out what kinds of fees or closing costs are charged for a new mortgage. Fees for the appraisal, loan application, title search, title insurance, home inspection, and legal advice are common costs. Loan origination fees (also called points) are the largest closing cost you will pay. A point is usually one percent of the total loan. One point or one percent of a $90,000 loan would be $900.

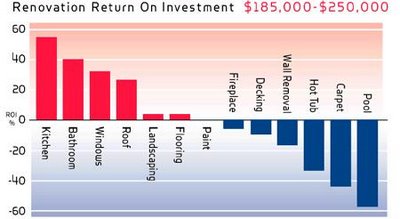

Best Home Renovation is to Upgrade an Old Bathroom

The return on investment on a mid-range bath modernization is 102% of its cost. Kitchens can add about 90% of their costs to the home's value.

The return on investment on a mid-range bath modernization is 102% of its cost. Kitchens can add about 90% of their costs to the home's value.Another home improvement that can pay off is window replacement. Not only does this job return about 90% on investment when the house is resold, it saves on energy bills every year.

As a rule, upscale improvements pay off at lower rates than mid-range or inexpensive ones. And making a house bigger and more luxurious that those of your neighbors will also cost a lot more than they'll return when the house is sold.

Ottawa Mayor Releases Plan for St. Joseph Blvd.

Ottawa Mayor announced his three point plan to beautify and boost economic development along St. Joseph Blvd. in the city's east end.

Ottawa Mayor announced his three point plan to beautify and boost economic development along St. Joseph Blvd. in the city's east end.Mayor Chiarelli will direct Hydro Ottawa to bury the overhead wires on St. Joseph Blvd.

He would also push to rezone segments of St. Joseph Blvd. to encourage development and redevelopment along certain portions of the street.

Our current zoning is preventing existing businesses from expanding and inhibiting the establishment of new businesses. Removing these barriers to growth will encourage more economic activity.

To Rent Or To Buy?

Steadily rising home prices and the recent upward drift in mortgage rates is tilting the economics of housing back in favour of renting over home ownership.

Steadily rising home prices and the recent upward drift in mortgage rates is tilting the economics of housing back in favour of renting over home ownership.The difference between the typical monthly mortgage payment on an average resale home in Canada and the average rent on a two-bedroom apartment is currently over $800 -- up from about $575 last year and as low as $250 per month in 1997.

This brings the affordability gap between the two competing accommodation choices back to levels not seen since 1990.

This growing gap is creating an economic decision of whether to rent or to own in many Canadians' minds.

Now that that gap is growing. It's just a part of the slowing down of the overall housing market.

Essentially what we saw in the late 1980s and early 1990s were rising home prices had pushed up that rent-versus-own gap to historic highs, and then you saw a period of cooling off in activity. We're going through a similar process, where gradually vacancy rates have moved up and home prices have moved up and you're getting a little bit of that shift.

Relative price trends in recent years have consistently favoured renters over homeowners. Between 2000 and 2005, renters' shelter costs increased at an average annual rate of 1.3 %. Homeowners' costs, on the other hand, rose an average 2.7 % yearly. Rising home prices have been a major inflationary factor, but homeowners have also faced relatively larger increases in insurance premiums and maintenance costs.

California Home Prices Seen Dropping 2% in 2007

The housing market continues its downturn with a nearly 12 % decrease in the number of houses sold in September 2006, compared with 2005.

The median home price in California will decline 2 % to $550,000 in 2007.

The housing market clearly downshifted in 2006 from the record-setting sales and robust price gains of the last few years. The residential real estate market in 2006 was characterized by a gap between buyer and seller expectations. Sellers sensed that the peak of the market was approaching, yet still hoped to obtain the highest possible prices. Buyers' sense of urgency waned as the number of homes on the market grew and they took longer to identify and subsequently purchase a home.

Wednesday, October 18, 2006

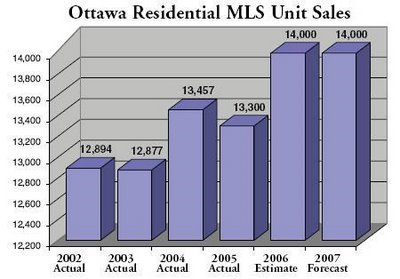

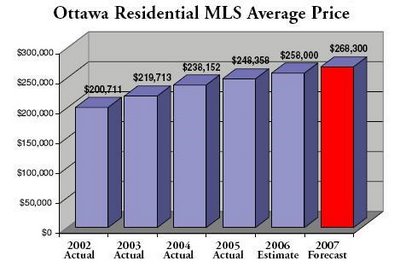

New Listings Expected to Slow Home Price Increases in 2007

Home buyers across the country will breathe a sigh of relief in 2007, thanks to a nationwide influx of new listings that is expected to slow price appreciation in major Canadian centres.

While the number of homes listed for sale is expected to climb, demand will remain strong in Ottawa.

Sales volume next year is expected to equal or under peak levels reported in 2005 and 2006, with more balanced conditions - characterized by healthy inventory levels and less urgency in the market - expected to emerge.

Nationally, 462,000 properties are forecast to change hands next year, making 2007 the third best year on record.

After four years of double-digit gains, average prices are expected to climb 5 % to $290,000 by year-end 2007, up from $275,000 a year ago.

Tuesday, October 17, 2006

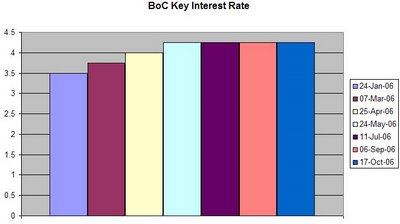

Canada Keeps Rate at 4.25%

The Bank of Canada kept its benchmark interest rate unchanged for a 3rd meeting, cutting its growth forecast while saying the risks of high consumer spending and falling exports are "roughly balanced".

The Bank of Canada kept its benchmark interest rate unchanged for a 3rd meeting, cutting its growth forecast while saying the risks of high consumer spending and falling exports are "roughly balanced". The target rate for overnight loans between banks remains 4.25 %, the highest since August 2001 and 1 % point less than the Federal Reserve's target.

The target rate for overnight loans between banks remains 4.25 %, the highest since August 2001 and 1 % point less than the Federal Reserve's target.There isn't any indication that they're getting ready to lower interest rates.

25 % Down-Payment Limit to be Lowered to 20 %

The federal department of finance has announced that the 25% down-payment limit is likely to be lowered to 20% by next summer 2007. This will obviously reduce the size of the market for CMHC. About 6-8% of homebuyers will no longer need mortgage insurance if the down-payment requirement is changed. With nearly half of all Canadian homebuyers requiring mortgage insurance.

The most homebuyers have little scope in selecting who insures their mortgages.

Ottawa Home Builders' Confidence Bottomed Out

Ottawa home builders' confidence about the market may have bottomed out.

Many builders viewed the current market for single-family homes as "poor".

The builders' near-term outlook isn't great, either, as only 15 % had good expectations about the market, compared to the 37 % who had poor expectations.

And the builders continue to report weak interest from potential buyers, with only 2.9 % reporting "high" customer traffic, unchanged from September. The survey also showed 59.5 % reporting "low" traffic, up slightly from September's reading and the biggest share reporting low trafffic since January 1995.

The home building market has at least bottomed out and can start to improve from here.

Monday, October 16, 2006

PM Stephen Harper Denied Privatization of CMHC

PM Stephen Harper denied a press report on Monday that said the government was considering privatizing the federal housing agency, calling it "a rumor that is utterly false."

The G&M newspaper cited anonymous private sector sources as saying the government was mulling the idea of selling the mortgage insurance and securitization units of Canada Mortgage and Housing Corp (CMHC).

Opposition lawmakers questioned the government extensively on the politically charged issue in Parliament on Monday, but after several denials by his cabinet minister Harper stood up to ridicule the line of questioning on what he called a rumor.

Diane Finley, minister of HRSD, categorically denied that privatization was on the minority Conservative government's agenda.

The G&M story cited financial market players as saying the idea had emerged from the Finance Department but that a decision was not imminent.

Q3 Sales Via MLS in Canada Dropped

Q3 sales via the Multiple Listing Service (MLS) in Canada dropped 6 % compared to Q3 2005 sales and fell 2.5 % compared to Q2 2006 sales.

Sales activity for the first 9 months of the year remained slightly ahead of levels recorded during the same period in 2005, and remains on a record pace.

Seasonally adjusted home sales activity via the Canada's major markets totaled 82,119 units in the Q3 of 2006, down 2.5 % compared to the Q2.

Transactions for the year to date in September were 0.7 % ahead of levels recorded for the same period last year. New sales records for the year-to-date in September were set in a number of major markets, including Calgary, Edmonton, Saskatoon, Winnipeg, Ottawa and Montreal.

The average price of homes jumped 10.1 % from Q3 2005 to Q3 2006, from $234,866 to $258,654.

The quarterly decline in sales combined with an increase in new listings caused the resale housing market to become more balanced than in any other quarter in the past 5.5 years.

Canada's housing market continues to head for a soft landing. The forecast indicates those trends will continue over the rest of the year and in 2007.

Ottawa Eyes Privatization of CMHC

The federal government is quietly testing the waters about privatizing the national housing agency, Canada Mortgage and Housing Corp (CMHC). That could bring billions of dollars into Ottawa's coffers but would also upset social-housing advocates and possibly cause upheaval in the bond market.

The federal government is quietly testing the waters about privatizing the national housing agency, Canada Mortgage and Housing Corp (CMHC). That could bring billions of dollars into Ottawa's coffers but would also upset social-housing advocates and possibly cause upheaval in the bond market.But Canada finmin denies privatization of housing agency.

A sale is not imminent, and observers believe there is no chance it would take place until after a federal election. Nor is there a cut-and-dried case in favour of privatization. But it's clear that the days of CMHC being a significant source of cash for the federal government are numbered -- with or without privatization.

CMHC, a Crown corporation charged with making housing more affordable and accessible, is making about $1-billion a year in profit and is sitting on a $5-billion reserve of retained profits.

The Crown corporation was created in the 1940s so that the state's access to cheap capital could be leveraged to make mortgages and home ownership affordable for most credit-worthy Canadian residents.

It now has four divisions: affordable housing, aboriginal housing, mortgage insurance and securitization.

About 96 % of the agency's profit comes from mortgage insurance. CMHC controls about 70 % of the country's mortgage insurance market, with the other 30 % held by Genworth Financial, a U.S.-based multinational formerly known as GE Mortgage Insurance Canada.

Sunday, October 15, 2006

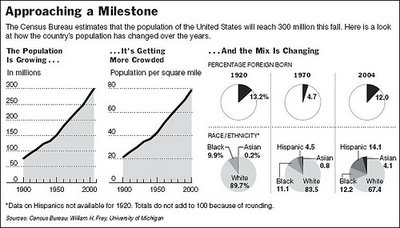

U.S. Population Hits 300,000,000

The U.S. population is on track to hit 300,000,000 on Tuesday morning, and it's causing a stir among environmentalists.

The U.S. population is on track to hit 300,000,000 on Tuesday morning, and it's causing a stir among environmentalists.People in the United States are consuming more than ever: more food, more energy, more natural resources. Open spaces are shrinking and traffic in many areas is dreadful.

About 40 % of U.S. population growth comes from immigration, both legal and illegal. The rest comes from births outnumbering deaths.

Saturday, October 14, 2006

How to Sell Your House Faster With Home Staging

Home stagers are interior designers who dress homes to make them more appealing to potential buyers. The goal is to make rooms look brighter and larger, depersonalize the space, and have it appear move-in friendly. In a competitive Housing Market, Ottawa Home Sellers need an edge. A professional stager can help secure a sale faster and for a better price.

It’s a marketing tool. People are emotionally tied to their home and can't look at them objectively. Staging is not decorating; decorating is personalizing, and staging is depersonalizing.

Homes listed without staging spent an average 4.5 months on the market while staged homes were on the market less than 1.5 months. Staged homes tend to fetch a selling price of 3 % more than un-staged homes.

When people sell a car, they get it serviced and detailed and sell it for a depreciated price. With a home, people want a profit yet they don’t bother to clean before a house showing.

Home staging doesn’t have to be expensive. The rate is calculated on the house size, how cluttered the home is, and its location.

Following an initial consultation, a staging can be done in a day. In the consultation the homeowner is advised about issues that must be addressed prior to staging, such as painting and landscaping. While in most cases, the families will stay in the home following a staging, there are some staging companies that will move inhabitants out temporarily until bids come in—some even move in a "model" family.

In most cases you won’t have to spend money on new furniture.

Home Staging Tips:

- Do a thorough cleaning, or hire a professional cleaner;

- Pack away personal collections and memorabilia. Use the basketball rule: anything smaller than a basketball should be put away;

- Rearrange furniture to make rooms seem more spacious and to provide better flow;

- Repaint walls neutral colors—off-white, etc;

- Look at your home as a buyer would.

Time to Invest in Housing Market. When?

The sharp weakening of the Ottawa property market is playing a major role in Ottawa's economic slowdown. The key movers are the falling housing construction and a significant rise in the mark-up rates, including those for the purpose of housing and construction. It is expected that the property prices will probably be flat or down for a while. The fall in prices in certain areas or former hot spots will be offset by stable showing in other previously unexplored parts of the Ottawa region.

The sharp weakening of the Ottawa property market is playing a major role in Ottawa's economic slowdown. The key movers are the falling housing construction and a significant rise in the mark-up rates, including those for the purpose of housing and construction. It is expected that the property prices will probably be flat or down for a while. The fall in prices in certain areas or former hot spots will be offset by stable showing in other previously unexplored parts of the Ottawa region.There are numerous studies worldwide support the view that property booms do not normally lead to serious busts unless or until the economy goes into a recession or some other factors come into play. The worrying factor on the economic front though is that while other countries, which have gone through a cycle of economic high, take heart in seeing the property slump as the cushion that will provide them with a soft landing, in Ottawa 's case we cannot really be sure about, whether or not we have truly gone through a period of high economic growth; and assuming we have, then has the period been long enough and the flight been high enough to even require a soft landing.

The key movers are the falling housing construction and a significant rise in the mark-up rates, including those for the purpose of housing and construction. It is expected that the property prices will probably be flat or down for a while. The fall in prices in certain areas or former hot spots will be offset by stable showing in other previously unexplored parts of the country.

It would be brave to buy a residential property in Ottawa today in the face of a slowing market. However, examples around the globe bear testimony to the fact that undervalued or economically strong areas will always advance in the long run, even if the present overall market presents a weak picture. The key is to be able to avoid the current property slowdown turning into a recession.

Friday, October 13, 2006

Is the Housing Bubble Ready to Burst?

Over the last five years home prices have skyrocketed and new home construction has kept pace. "he deceleration has been the fastest in history. Has the day of reckoning come, is the real estate market in for a total collapse, or is it just in for a "soft landing" that most of the market optomist have hoped for?

With most developers cutting back on construction as overproduction have left them with big inventories of unsold homes, plummiting home prices and lower interest rates might bring a flurry of new buyer which might just temporarally relieve the pain.

Housing is a multiplier industry, the impact of the growing real estate crisis impact is felt into many other industries that depend on it. Financial instatutions, lumber manufacturers, furniture stores, cunstruction related work, and other are dependent on this "economic bubble", which is the biggest in history of Canada.

Will its collapse recreate the same resecion of 1929, or is it just a bunch of hype? We dont know just yet. One thing is for sure, the artificailly priced market of 2005 is finally getting back to reality and if you have any plans on buying a home, now is the time to do it. Prices are comming back to reality, interest rates are

dropping, and good deals are abundent.

Thursday, October 12, 2006

Does Harper Understand How Housing Market Works ?

In the today's article discussing U.S.-Canada Softwood lumber deal, I found the interesting point that:

Harper blamed the job losses on a "softening" of the American lumber market, where demand has dropped because rising mortgage rates have squeezed the housing market and reduced new home starts.Does Harper Understand How Housing Market Works ? No. He did not.

All Government contracts are going to booming Alberta.

Ottawa Top Homebuilders Bullshit

I found this sponsored story in Ottawa Business Journal with billshit answers about the future of the Ottawa Housing Market from Ottawa Top Homebuilders as Minto, Urbandale and Tartan.

I found this sponsored story in Ottawa Business Journal with billshit answers about the future of the Ottawa Housing Market from Ottawa Top Homebuilders as Minto, Urbandale and Tartan.Look at the answers or check the website:

Q1: How would you characterize the residential market in the city at present?

Minto:

A reasonable market, strong first time homebuyers market, fair move-up market.Urbandale:

We have a relatively balanced market with a little more strength in the townhouse market than the single-family homes.Tartan:

We sell suburban housing in the south end and west end. The market has levelled off from a few years ago, but is still strong and stable, relative to the last 10 years or so.Q2: How has the market cycle of the past eight years impacted your business? What impact do you expect it to have going forward?

Minto:

Minto has gone from building 500 homes a year to over 1,000 homes a year in that time period. Looking ahead, we are well positioned to respond to the market.Urbandale:

It's taught us to be more attuned to customer needs, in order to be able to react quickly to emerging trends. By offering a variety of home designs and lots sizes, in different locations, the company is better able to respond to changing market requirements in the future.Tartan: