Clouds Over Condos: Are Stormy Times Ahead?

In Boston, a condominium developer is asking new owners to help it promote its unsold units, while another is putting in hardwood floors free. In Sarasota, Fla., sellers of condos are offering buyers incentives such as exclusive golf-club memberships worth as much as $75,000. In Atlanta, the developer of a high-rise is promising shoppers it will pay their first year of condo-association fees.

Perks being offered by sellers? Until recently, buyers in many markets were competing for the chance to snap up new condos downtown. But even as many cities continue to see condo prices appreciate, there are spreading signs that the market may be cooling, just as in the overall market. The worry for investors is that this real-estate slowdown will mirror that of the early 1990s, when condo values in some markets dropped more sharply than those of single-family homes, in part because many had been bought by speculators -- the same kind of speculative buying that has fueled this era's boom.

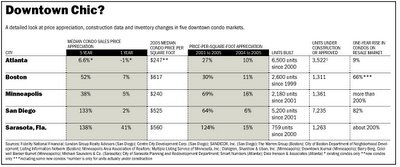

To see how condominiums are faring this time around, we took a look at five U.S. cities, aiming for regional spread and active markets: Boston, Atlanta, Minneapolis, San Diego and Sarasota, Fla. We began by interviewing local real-estate brokers, market analysts, buyers and sellers. We also reviewed data on everything from price-per-square-foot appreciation to the change in the number of condos on the market over the past year.

The similarities were striking. While all of the downtown condo markets had strong overall sales in 2005, their resale markets showed signs of struggle. In San Diego, where condo prices more than doubled from 2001 to 2005, inventory (units being sold by owners, not developers) rose more than 80% in 2005, according to local agent Lew Breeze. In the same period, inventory in Minneapolis tripled, according to Barry Berg of Coldwell Banker Burnet. In Las Vegas, the epicenter of the condo boom, at least four condo projects have been scrapped, including Icon Las Vegas, which had already sold contracts for units.

Of course, a lot could change this spring, a time when real-estate transactions traditionally pick up. The combination of an overall strong economy, low long-term interest rates and the migration of baby boomers to city centers is likely to "mitigate a softening" in condo prices, says Karl Case, a professor of economics at Wellesley College.

Below is our survey of downtown condo markets in five cities across the country.

Atlanta

IN A SNAPSHOT: To drive up sales and per-square-foot prices, developers have shrunk condo units 12%.

The condo market in Atlanta's core "intown" areas -- Downtown, Midtown and Buckhead -- took off after the city hosted the Summer Olympics in 1996, and sales have continued at a record pace. Last year, 4,089 condos were sold in the area, a 34% jump according to data tracker Smart Numbers, which gathers data from a multiple-listing service and property deeds. The median price per square foot for new construction also rose 10% to $247 after dropping 2% in 2004.

Still, median sales prices for intown condos fell 1% last year because of a burst of new, cheap units. To drive sales, developers have reduced condo-unit sizes. According to Smart Numbers, median condo size dropped 12% to 972 square feet from 2004 to 2005. Developers also have begun to offer incentives. At Paces 325, a high-rise in Buckhead that was completed in mid-2004, the developer recently began offering to pay homeowners-association dues ($270 to $450 a month) for new buyers for a year. Why? Half of the building's 206 units, priced from the $190,000s to $400,000s, are unsold. The incentive "comes and goes as needed," says Jennifer Rust, the sales manager.

Sellers of existing condos are also coming up with inducements. Lenaya Miller, a real-estate agent who sold her six-year-old condo near Midtown in October for $164,000, says she paid the buyer's first year of homeowners-association fees ($5,000) and the closing costs ($4,900). "To be competitive, I gave them everything but the shirt off my back," she says.

Boston

IN A SNAPSHOT: Median condo price per square foot rose 11% last year to $617; existing condo sales fell 30% from a year earlier.

In terms of price appreciation and sales, downtown-Boston condos peaked in 2004. But it wasn't until the last quarter of last year that developers and sellers of existing condos really started to feel the impact -- as condo resales fell 30% from a year earlier, according to Listing Information Network, a real-estate data firm.

To spur sales, developers are offering everything from free upgrades to shopping sprees. One is Porter 156, a 217-unit condo conversion completed last fall in a former bra factory. The building, in East Boston, has about 25 unsold new loft-style units and 25 just-purchased units on the market for $300,000 to the mid-$600,000s, local agent Brian Perry says. That has prompted its developers, ELV Associates and Metric Construction, to turn to residents for help: During the December holidays, the developers left cards in owners' apartments offering a $1,000 gift certificate to Ikea for owners who found buyers for any remaining units. The developer of Parris Landing at the Navy Yard, completed in 2004, is giving buyers free upgrades on features such as hardwood floors ($10,000) and is writing off condo fees for a year ($400 to $700 a month).

Minneapolis

IN A SNAPSHOT: While a major correction is unlikely, local analysts say they expect a lull in the market.

This Midwestern city has enjoyed some notable expansion in the past few years. Not only has the downtown area's population increased by a third, to 30,300, since 2000, it has a new theater, public library and some museum expansions planned for later this year.

The condo market has experienced a parallel boom, with 1,326 units selling last year, up from 557 in 2004, according to the Minneapolis Area Association of Realtors. And compared with the other markets we looked at, the city had fewer speculators and smaller price increases, making it less susceptible to major corrections.

But things have slowed recently. There were four sales of existing condos in January, compared with 27 a year earlier, according to MAAR, and brokers say shoppers are taking longer to buy. That has prompted developers to take the initiative. One example is the 39-story Carlyle, which is scheduled for completion in December. Developers APEX Asset Management and Opus have presold 240 of the building's 255 units, taking down-payments of 5% to 10% on units costing $250,000 to $1.5 million. In hopes of keeping those buyers from backing out of their contracts, the developers have treated them to bicycle tours of downtown, a group trip to a University of Minnesota Gophers football game and a private holiday party in December at the newly renovated Walker Art Center. The idea is to create a sense of community, says Bob Lux, a principal at APEX. "Instead of spending the money on marketing, we were able to spend that money on our existing residents," he says.

San Diego

IN A SNAPSHOT: Prices dropped from the end of 2004 to the end of 2005 -- the first such drop since 2001.

Of the condo markets we surveyed, San Diego showed the strongest signs of a slowdown. In the fourth quarter of 2005, the median price per square foot for downtown condos fell to 0.2% to $517 from a year earlier -- the first year-over-year drop since 2001, according to London Group Realty Advisors, a research firm. San Diego also had an 82% rise in inventory of existing condos last year as speculators stopped buying. Many also backed out of contracts and forfeited their downpayments: In San Diego County, the number of canceled purchase agreements for new condos and townhouses jumped by 75%, to 264, from the second quarter to the fourth quarter of 2005, according to MarketPointe Realty Advisors, a local market-analysis firm.

For Rachelle Amini, such developments strengthened her bargaining position when she found a two-bedroom condo in a downtown high-rise last fall. The 28-year-old psychotherapist says she talked the investor-seller down to $1.15 million -- $50,000 less than he had paid for it in 2004. He also threw in two plasma TVs and a new white sofa. "It was definitely a good deal," she says.

Still, downtown San Diego has continued to expand rapidly. Since 2001, the population has risen by about 12,000, to about 30,000, according to Centre City Development Corp., a nonprofit downtown-redevelopment group. And since the completion in 2004 of Petco Park, home of the San Diego Padres baseball team, the East Village district has done especially well, adding retail and office developments.

Sarasota, Fla.

IN A SNAPSHOT: An overbuilt downtown condo market is leading to incentives such as deals on beach-club memberships.

The downtown market has been on a tear since the Ritz-Carlton, which included 50 residences atop the hotel, was completed in 2001. More than a dozen condo projects have been built since then in this city of 55,000, and there are as many units under construction now as have been completed over the past six years. Plus, about 273 condos are on the market.

That's almost triple the amount of condos on the market here a year ago, according to real-estate firm Michael Saunders & Co. And more continue to be announced, including Marquee on the Bay, a 16-story tower with 12 units starting at 4,750 square feet for $3 million, and the Grande Sarasotan, with 144 condominium units priced from $1 million to $3 million.

"Where are the people going to come from?" says broker Barbara Ackerman, who predicts the median condo price in downtown will drop a "minimum of 10%" this year.

January is typically a slow month here, but this year there were six condos that resold, down from 14 in January 2005, according to Michael Saunders & Co. It's no longer uncommon for sellers to offer hard-to-get golf and beach-club memberships, which can cost as much as $75,000 apiece. Bert and Jane Kummel, retirees who put their three-bedroom condo on the market for $2.4 million at Thanksgiving, have thrown in $1,000 worth of opera tickets as a lure. But to no avail, says Mrs. Kummel: "It's a great marketing idea, but people just aren't buying like they were."

0 Comments:

Post a Comment

<< Home