US Fed raises rates again to 4.5%

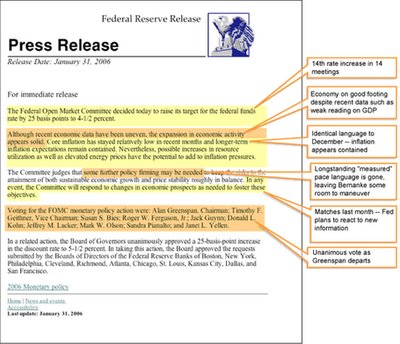

The Federal Reserve raised a key short-term interest rate another quarter-point Tuesday and said it may have to raise rates further in chairman Alan Greenspan's last meeting after more than 18 years at the helm of the central bank.

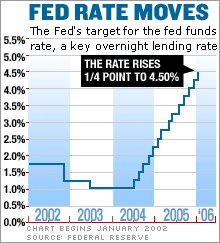

After the latest rate hike, the central bank's fourteenth since June 2004, the target for the federal funds rate now stands at 4.5 percent, the highest in nearly five years. The overnight bank lending rate is important since it influences the rates consumers and businesses pay on many types of loans.

The Fed had hinted in the minutes of its past two meetings that its series of rate hikes may soon be nearing an end. But in the statement accompanying Tuesday's decision, the central bank said that "some further policy firming may be needed," an indication that the Fed has not finished raising rates just yet.

However, analysts in the one-more-and-done camp argue that the economy is already slowing as rising interest rates begin to cool the red-hot housing market. If the Fed overdoes the tightening, it could cause a more severe slump in housing.

0 Comments:

Post a Comment

<< Home